Renewals drive majority share of leasing activity

MARKET HIGHLIGHTS

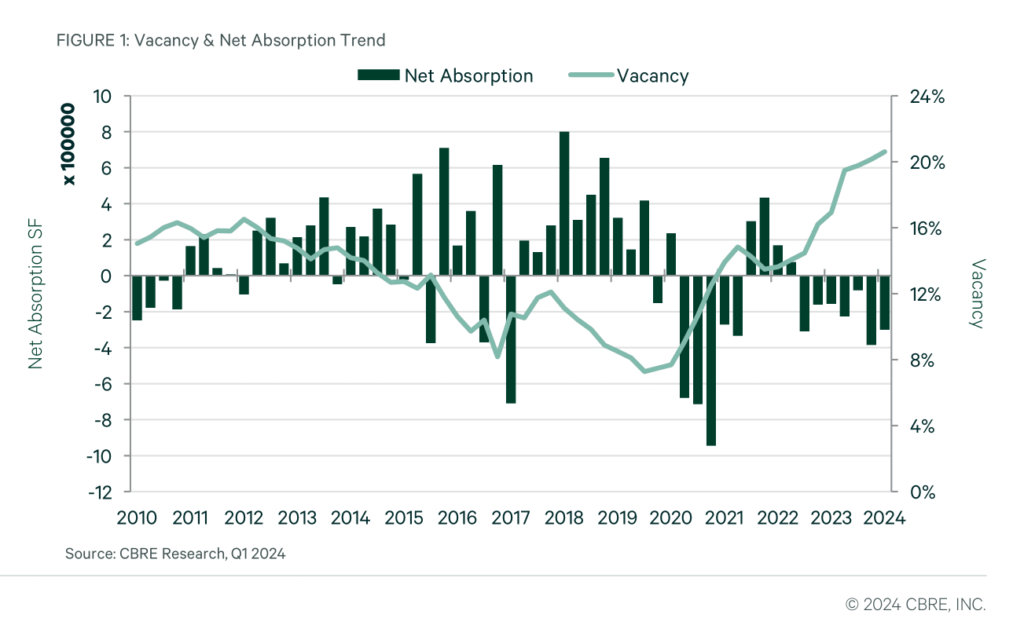

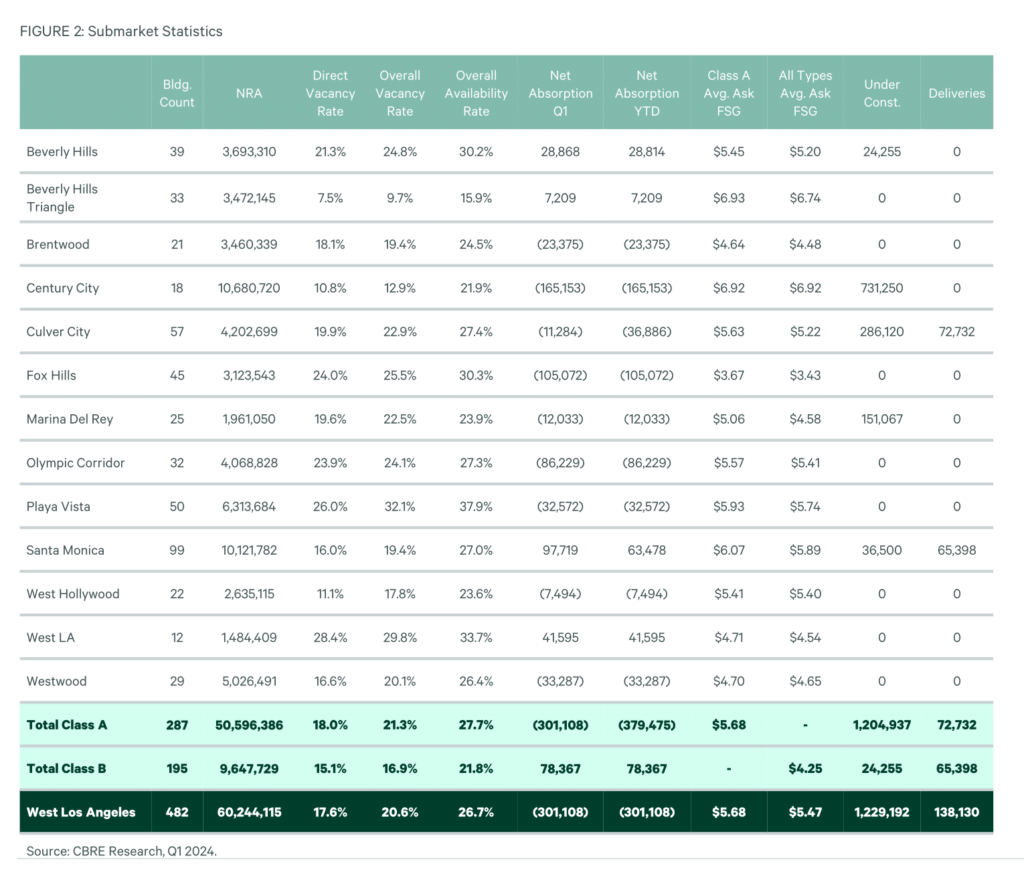

- West Los Angeles (West LA) saw more than 615,000 sq. ft. of total vacant space hit the market in Q1 2024, resulting in 301,108 sq. ft. of negative absorption.

- The average direct asking rate decreased slightly to $5.47 FSG per sq. ft. per month; down 0.55% quarter-over-quarter and up 0.92% year-over-year.

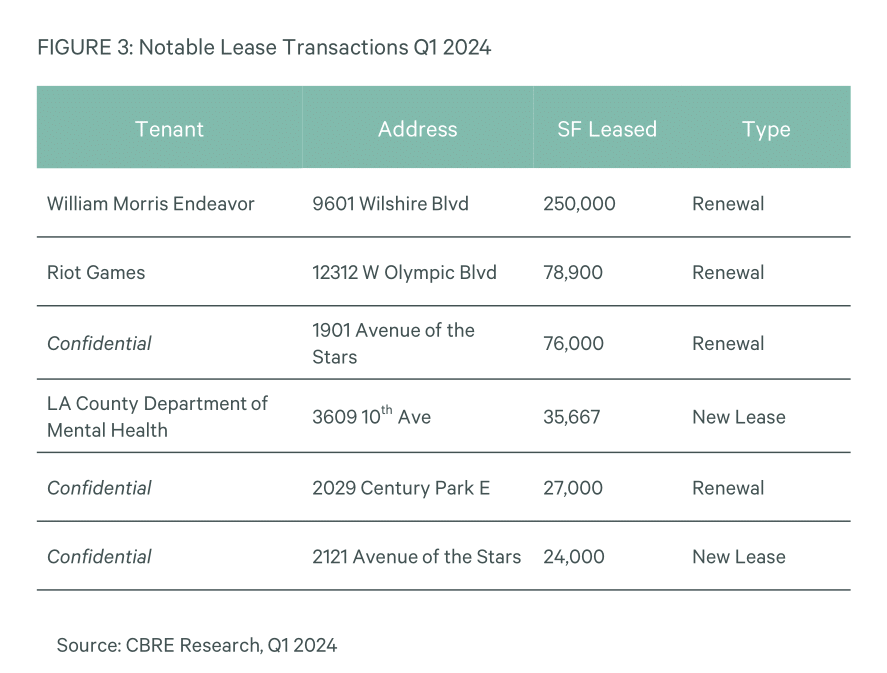

- West LA continued to dominate leasing activity in Greater Los Angeles, representing 28% of the total sq. ft. leased in Q1 2024.

- Renewal activity held strong in West LA, led by William Morris Endeavor’s 250,000 sq. ft. renewal at 9601 Wilshire Blvd. Additionally, Riot Games renewed for 78,900 sq. ft. at 12312 W Olympic Blvd and a confidential Law Firm renewed for 76,000 sq. ft at 1901 Avenue of theStars.

- Large blocks of sublease space remained on the market at the close of Q1 2024, particularly in Beverly Hills, Playa Vista, and Santa Monica, due to the ongoing challenge of finding large tenants. However, smaller high-end sublease spaces of 10,000 sq. ft. or less saw significant activity, resulting in a 4.20% decrease in sublease availability from the previous quarter.

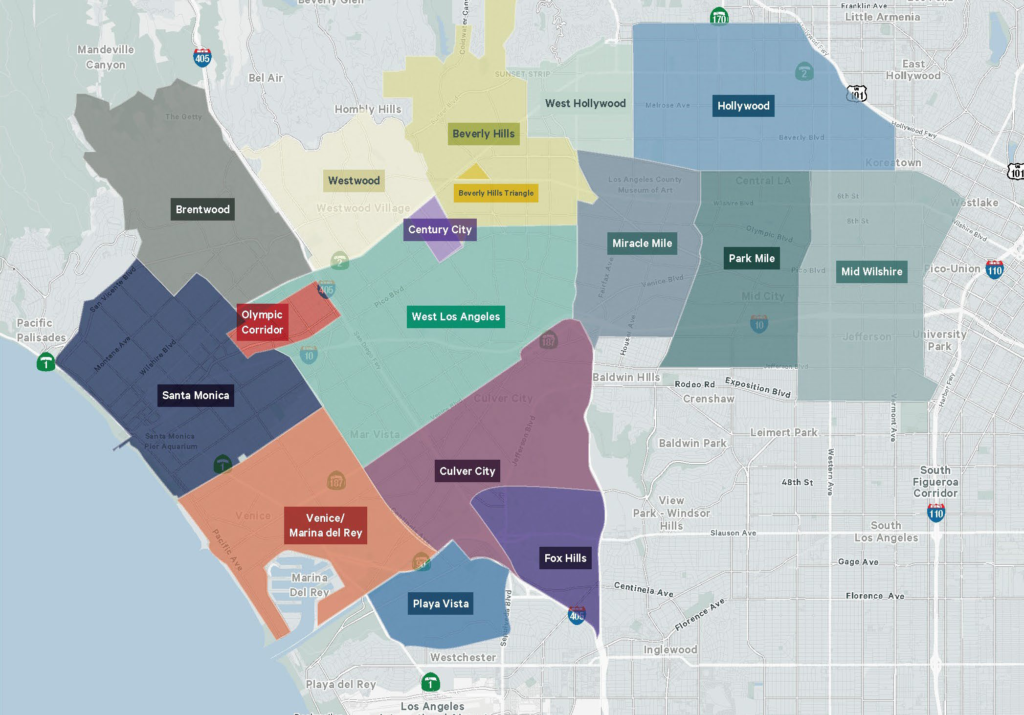

Submarket Map

Definitions

Available Sq. Ft.: Space in a building, ready for occupancy; can be occupied or vacant. Average Asking Lease Rate: A calculated

average that includes net and gross lease rate, weighted by their corresponding available square footage. Building Area: The total

floor area sq. ft. of the building, typically taken at the “drip line” of the building. Full Service Gross (FSG) Rate: The landlord

assumes responsibility for all the operating expenses and taxes for the property. Gross Activity: All lease transactions completed

within a specified time period. Net Absorption: The change in Occupied Sq. Ft. from one period to the next. Positive absorption is

reflected when a lease is signed, which may not coincide with the date of occupancy. Rentable Area: The Building Area minus the

elevator core, flues, pipe shafts, vertical ducts, balconies and stairwell areas. Vacant Sq. Ft.: Space that is not occupied

Survey Criteria

Includes all Class A and B office buildings 30,000 sq. ft. and greater in size in Los Angeles and Ventura counties. Owner-user

buildings are not included in the survey. This survey excludes medical office buildings. Buildings which have begun construction as

evidenced by site excavation or foundation work.

Contacts

Spencer Small

Siyuan Ma

Konrad Knutsen

Andy Ratner

Source: CBRE Research, Q1 2024, Location Intelligence

© Copyright 2024 All rights reserved. Information contained herein, including projections, has been obtained from sources believed to be reliable, but has not been verified for accuracy or completeness. CBRE, Inc. makes no

guarantee, warranty or representation about it. Any reliance on such information is solely at your own risk. This information is exclusively for use by CBRE clients and professionals and may not be reproduced without the

prior written permission of CBRE’s Global Chief Economist.