Entertainment industry begins to show signs of life

MARKET HIGHLIGHTS

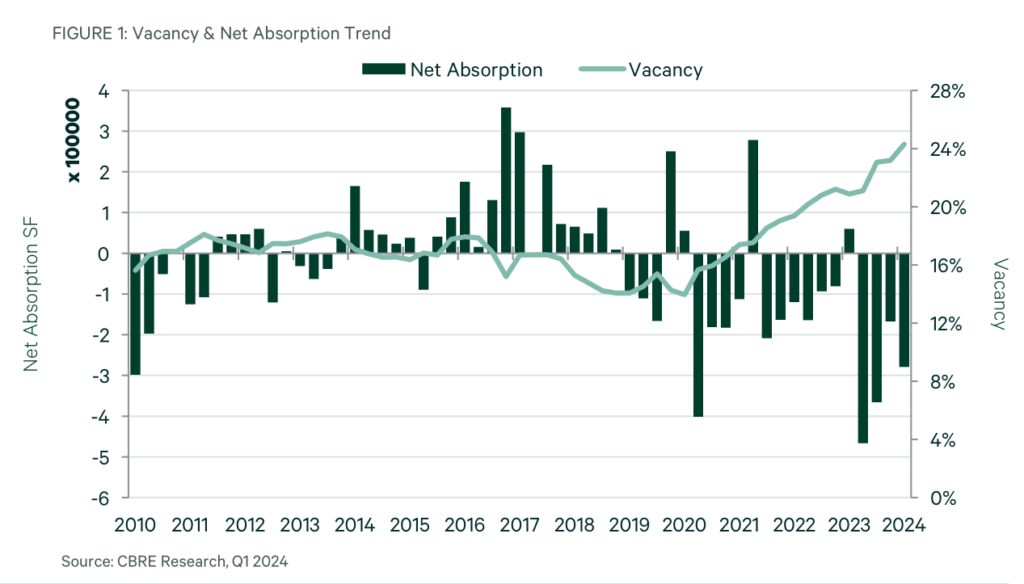

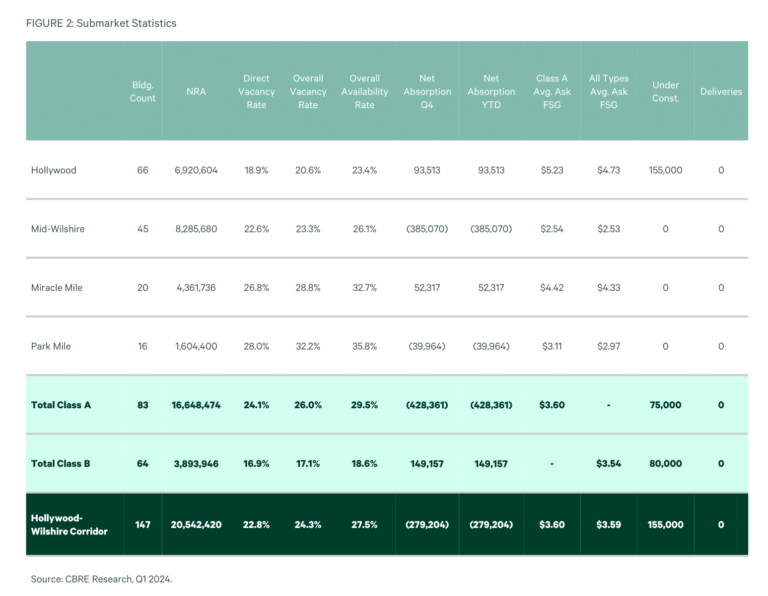

- The vacancy rate in Hollywood-Wilshire Corridor (HWC) increased to 24.3% in Q1 2024 as space hitting the market continued to overshadow new leasing activity

- The average direct asking rate in the HWC decreased by 1.37% to $3.59 FSG per sq. ft. per month due to a persisting decline in demand for office product.

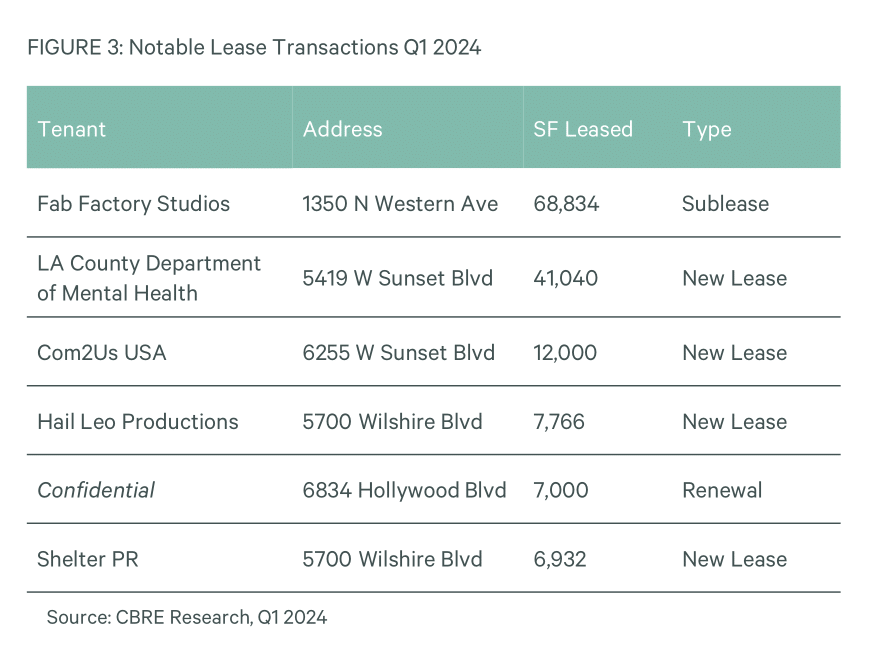

- The Hollywood district saw positive absorption, mainly attributed to Fab Factory Studios securing a 68,834 sq. ft. lease at 1350 N Western Ave and the LA County Department of Mental Health signing a 41,040 sq. ft. new lease at 5419 W Sunset Blvd.

- Echelon at 717 Seward St led by BARDAS Investment group officially broke ground and is expected to deliver in December of 2024.

- Despite the HWC experiencing a negative quarter, the entertainment industry’s activity is expected to gain momentum now that the strikes are in the rearview. With production levels and content spending on the rise, the HWC is poised to steer in a positive direction as more employees return to work.

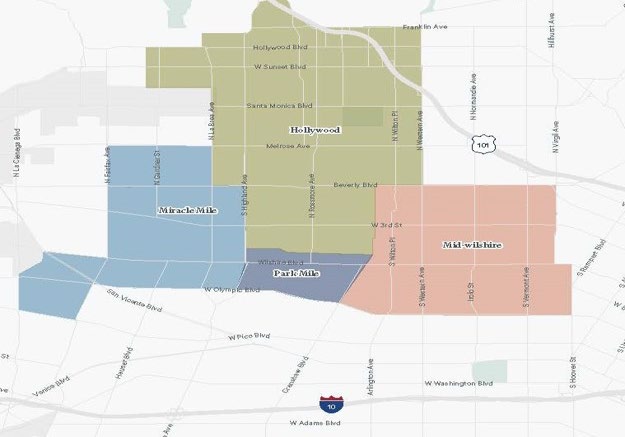

Submarket Map

Definitions

Available Sq. Ft.: Space in a building, ready for occupancy; can be occupied or vacant. Average Asking Lease Rate: A calculated average that includes net and gross lease rate, weighted by their corresponding available square footage. Building Area: The total floor area sq. ft. of the building, typically taken at the “drip line” of the building. Full Service Gross (FSG) Rate: The landlord assumes responsibility for all the operating expenses and taxes for the property. Gross Activity: All lease transactions completed within a specified time period. Net Absorption: The change in Occupied Sq. Ft. from one period to the next. Positive absorption is reflected when a lease is signed, which may not coincide with the date of occupancy. Rentable Area: The Building Area minus the elevator core, flues, pipe shafts, vertical ducts, balconies and stairwell areas. Vacant Sq. Ft.: Space that is not occupied.

Survey Criteria

Includes all Class A and B office buildings 30,000 sq. ft. and greater in size in Los Angeles and Ventura counties. Owner-user buildings are not included in the survey. This survey excludes medical office buildings. Buildings which have begun construction as evidenced by site excavation or foundation work.

Spencer S

Contacts

Spencer Small

Siyuan Ma

Konrad Knutsen

Andy Ratner

Source: CBRE Research, Q1 2024, Location Intelligence

© Copyright 2024 All rights reserved. Information contained herein, including projections, has been obtained from sources believed to be reliable, but has not been verified for accuracy or completeness. CBRE, Inc. makes no

guarantee, warranty or representation about it. Any reliance on such information is solely at your own risk. This information is exclusively for use by CBRE clients and professionals and may not be reproduced without the

prior written permission of CBRE’s Global Chief Economist.