Greater Los Angeles continued to face turbulent market conditions

MARKET HIGHLIGHTS

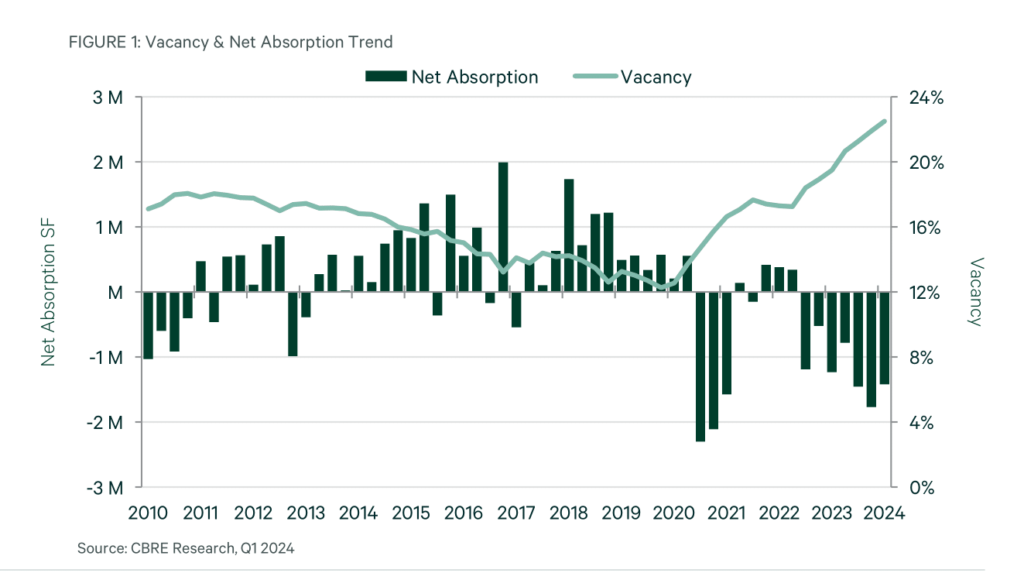

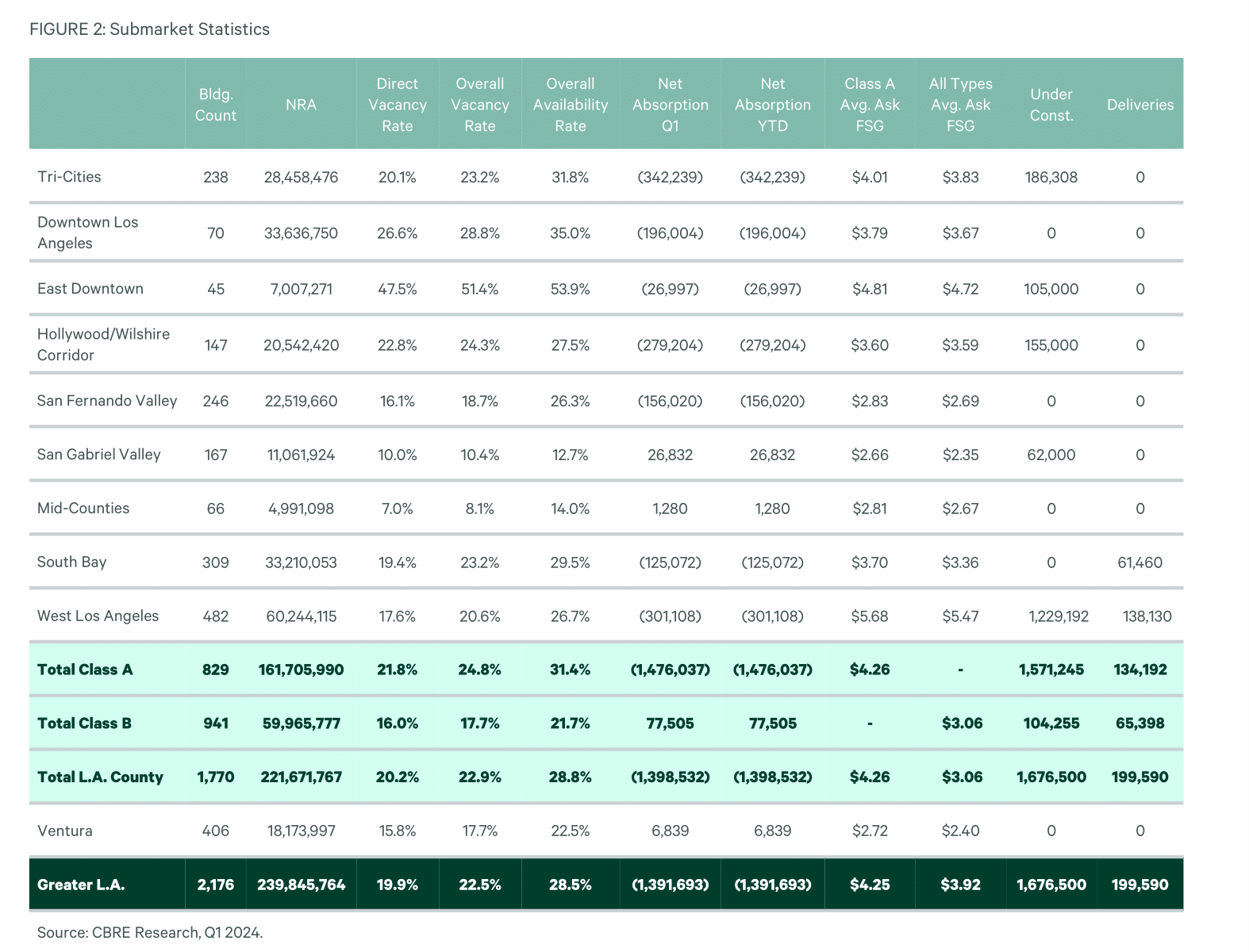

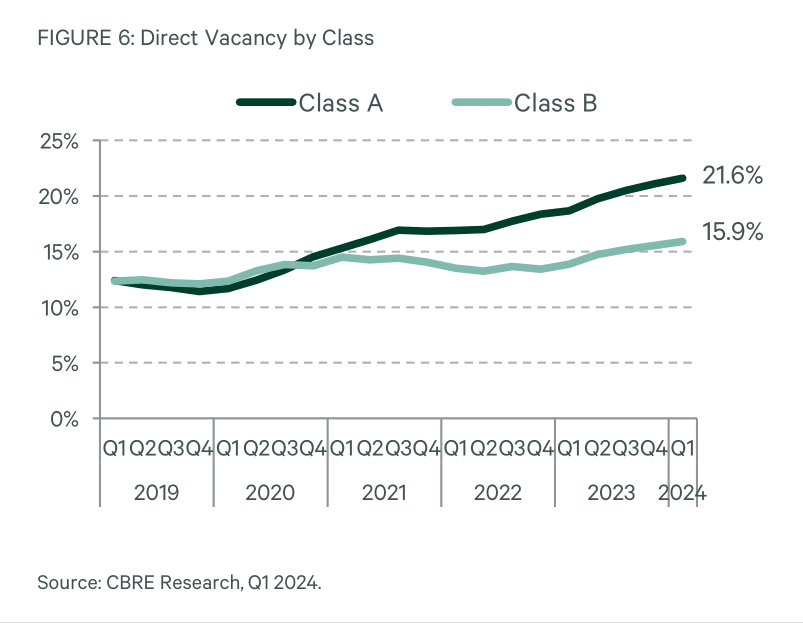

- The overall vacancy rate ended Q1 2024 at 22.5%, elevated by 1.42 million sq. ft. of negative net absorption. The overall availability rate ended the quarter at 28.5%.

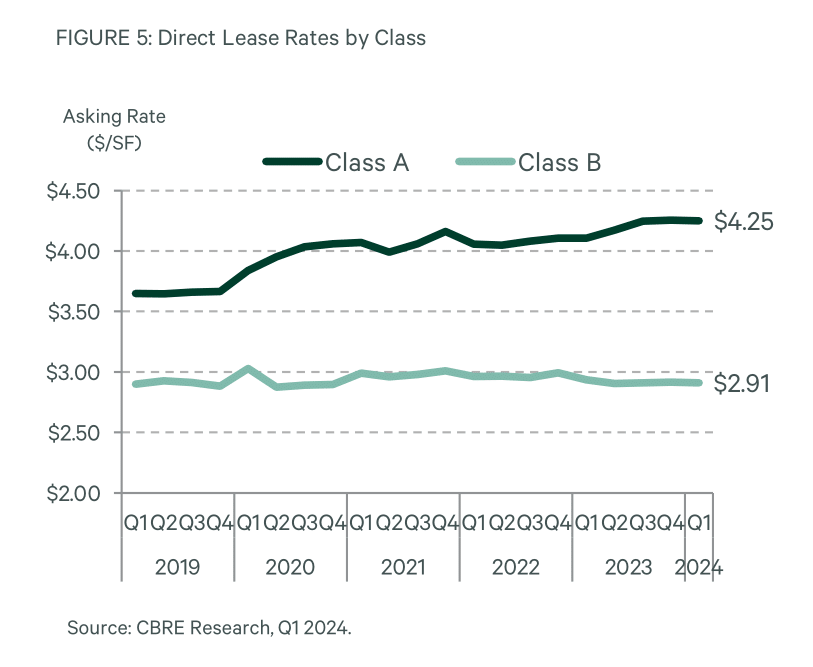

- The average direct asking rate remained declined slightly by $0.01 to $3.92 FSG. Since Q1 2020, the average asking rate has increased by 8.9% driven by a greater saturation of Class A

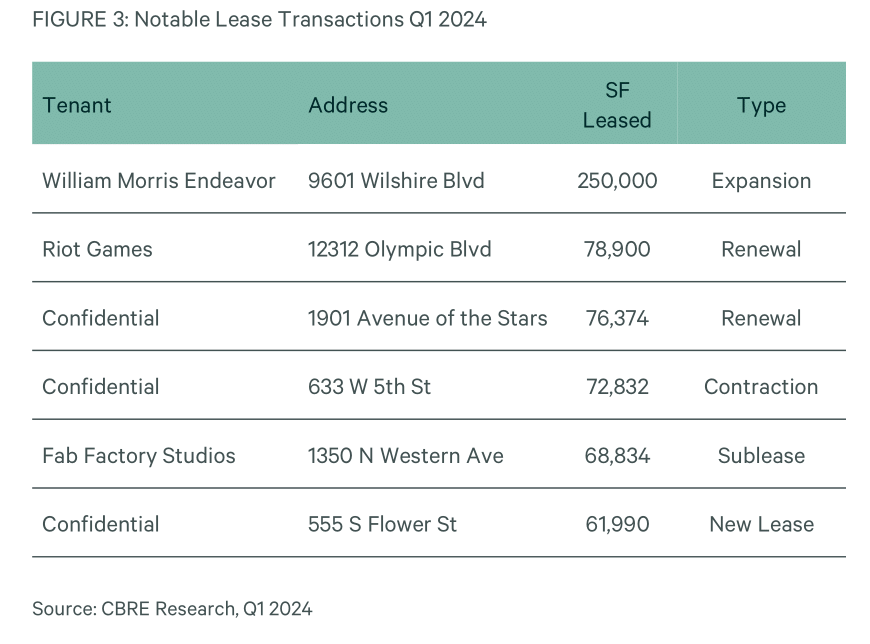

and premium spaces on the marke - Total leasing activity was 2.27 million sq. ft. in Q1 2024. This was 31.6% lower than Q4 2023

- Total tenants in the market demand stood at 10.1 million sq. ft. at the end of Q1 2024, consisting of 42 tenant requirements exceeding 50,000 sq. ft. throughout GLA.

- Office-using employment in combined Los Angeles and Ventura Counties totaled 1.17 million in Q1 2024, a marginal increase from Q4 2023, however a decrease of 0.9% since Q1 2023.

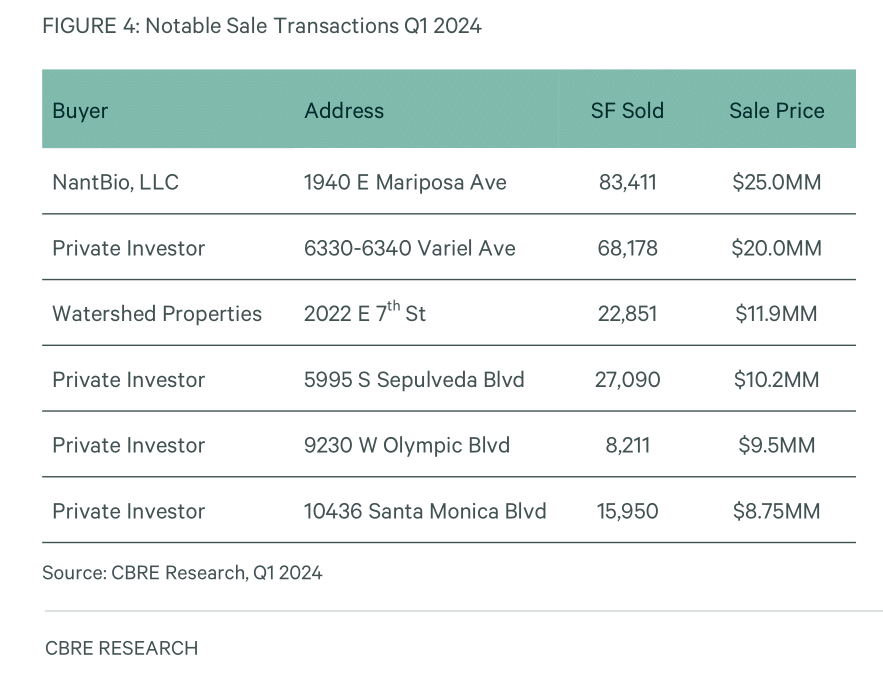

- Eighteen sale transactions over 10,000 sq. ft. closed in Q1 2024, totaling 372,200 sq. ft. and $143,000,000 in sales volume

OFFICE MARKET OVERVIEW

- The Greater Los Angeles (GLA) office market reached its highest overall vacancy rate in more than twenty years in Q1 2024 as a result of tepid office demand, driven by the widespread standardization of hybrid work policies. The region is poised to experience further declines in rental rates as vacancy is predicted to continue increasing. This will likely prompt developers and investors to approach their ventures with careful consideration and moderation

- Rates remained steady only decreasing $0.01 from the previous quarter to $3.92 FSG per sq. ft. per month as landlords upheld rents while continuing to offer favorable concessions to attract tenants. However, the average asking rate is up $0.07 from the previous year driven by a disproportionately higher amount of Class A and premier office spaces as well as rising operating expenses.

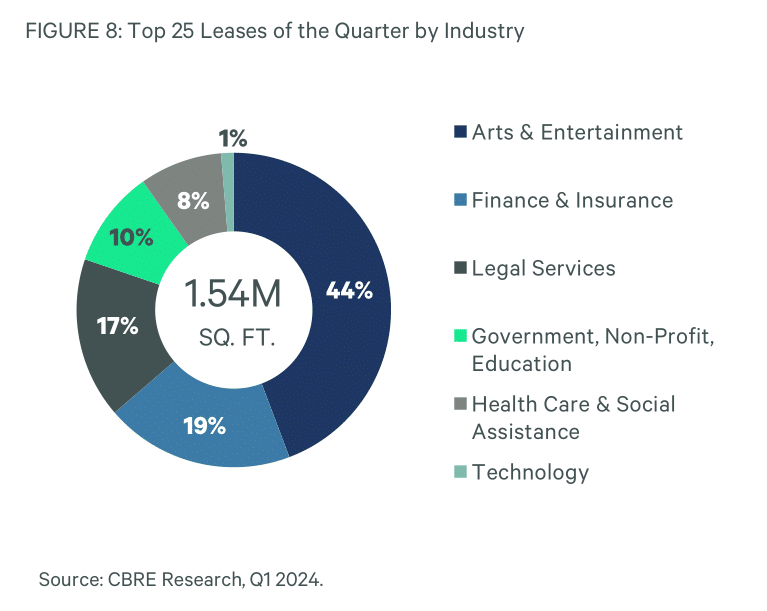

- Total leasing activity across GLA finished at just over 2.4M sq. ft., which is down 26.5% from the previous quarter. New leases accounted for 66% of the total amount of leases signed in GLA, while renewals made up the remaining 34%. West Los Angeles remained the premier destination across the region as the submarket experienced the three largest leases signed in Q1 2024. The average lease size of 10,200 sq. ft. signifies a 23% increase from the previous year, reflecting a growing confidence amongst occupiers in their real estate decisions.

- GLA reported negative absorption of 1.4 million sq. ft.. The Tri-Cities submarket contributed the most negative absorption with -340,000 sq. ft., followed by West Los Angeles with -300,000 sq. ft.., and the Hollywood-Wilshire Corridor with – 275,000 sq. ft.

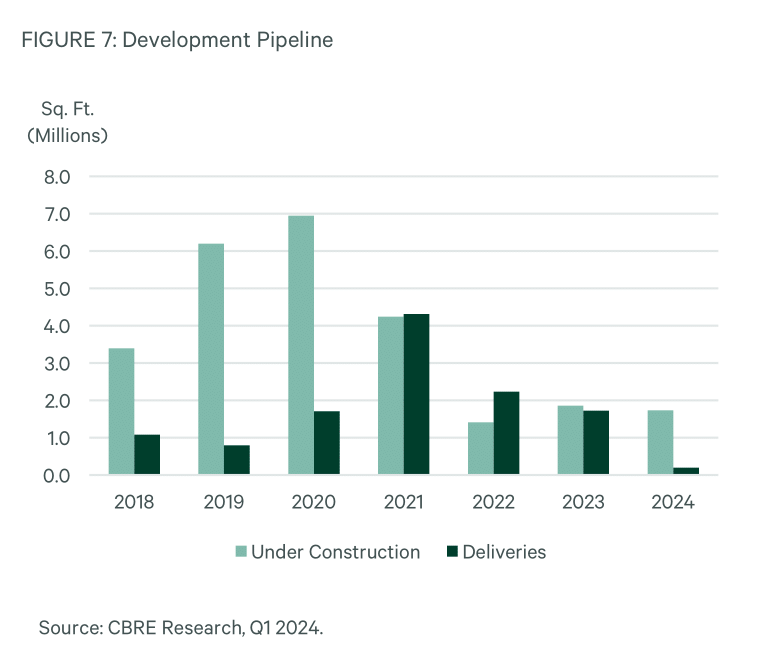

- In Q1 2024, a total of four office projects completed construction across GLA. Among these properties, 5237 W Jefferson in Culver City and 1650 Euclid St in Santa Monica both delivered fully vacant, leading to the overall increase in vacancy in GLA. Additionally, the project located at 3810-3816 Stineman Ct was partially leased upon its completion in Q1 2024. GLA concluded the quarter with just over 1.7M sq. ft. of office product under construction.

Submarket Map

Definitions

Available Sq. Ft.: Space in a building, ready for occupancy; can be occupied or vacant. Average Asking Lease Rate: A calculated average that includes net and gross lease rate, weighted by their corresponding available square footage. Building Area: The total floor area sq. ft. of the building, typically taken at the “drip line” of the building. Full Service Gross (FSG) Rate: The landlord assumes responsibility for all the operating expenses and taxes for the property. Gross Activity: All lease transactions completed within a specified time period. Net Absorption: The change in Occupied Sq. Ft. from one period to the next. Positive absorption is reflected when a lease is signed, which may not coincide with the date of occupancy. Rentable Area: The Building Area minus the elevator core, flues, pipe shafts, vertical ducts, balconies and stairwell areas. Vacant Sq. Ft.: Space that is not occupied.

Survey Criteria

Includes all Class A and B office buildings 30,000 sq. ft. and greater in size in Los Angeles and Ventura counties. Owner-user buildings are not included in the survey. This survey excludes medical office buildings. Buildings which have begun construction as evidenced by site excavation or foundation work.

Contacts

Alex Hall

Siyuan Ma

Matthew Hocum

Matthew Hocum

Matthew Hocum

David Cannon

Carter Chillingworth

Maxine David

Aidan Carlisle

Konrad Knutsen

Source: CBRE Research, Q1 2024, Location Intelligence

© Copyright 2024 All rights reserved. Information contained herein, including projections, has been obtained from sources believed to be reliable, but has not been verified for accuracy or completeness. CBRE, Inc. makes no

guarantee, warranty or representation about it. Any reliance on such information is solely at your own risk. This information is exclusively for use by CBRE clients and professionals and may not be reproduced without the

prior written permission of CBRE’s Global Chief Economist.